I am running the Introduction to Public Sector Procurement for CIPS in Manchester on 26th June 2018. Full details are here.

Next one after that will be Edinburgh on 28th September (adapted to Scottish public procurement regulations, but also suitable for English, Welsh and Northern Irish delegates). Then 20th November in London.

The last 2 courses will also have a second day going into more detail about some of the less common procurement routes such as Competitive Dialogue - Applying the Public Procurement Regulations.

The London event will also have the third part of the programme - the Future of Public Procurement.

Alternatively you could go for a 3 day course combining all 3 days, with a bit of extra stuff, in the Public Sector Skills Programme which we like to call the Summer school in public procurement - London 7/9 August, Manchester 21-23 August, and Edinburgh 4-6 September.

Hope to see you at some (but not all).

Tuesday, 12 June 2018

Monday, 21 May 2018

YPO - Yorkshire Purchasing Organisation

Had a good afternoon touring YPO as part of the South Yorkshire CIPS branch.

Very successful and very pleasant organisation. Looking forward to hearing more about their sustainability drive which is linked to UK Global Sustainable Development Goals.

Very successful and very pleasant organisation. Looking forward to hearing more about their sustainability drive which is linked to UK Global Sustainable Development Goals.

Monday, 30 April 2018

Sainsbury's, ASDA WalMart and Morrisons

The news is that supermarkets ASDA and Sainsbury's are looking to merge. Lots of reportage discusses how they will look for efficiencies, and improved leverage over suppliers (presumably to match Tesco).

According to industry stats here the combined ASDA/Sainsbury will have a larger market share than Tesco (30% compared to 28%) but after required divestments that may mean they are of very comparable size.

The question is - What next for Morrisons? Currently in 4th place with 10% they will automatically go up to 3rd, but be a third of the size of the two big supermarkets. This is stick or bust time I suggest. They could pick up retail units that ASDA/Sainsbury have to relinquish to please the authorities. But do they then go all out to get to, say, 15% share? OR do they stay where they are and hope to fend off Aldi on 7%?

I live in the home of Morrisons, Bradford, and would hope they go for growth, but part of me thinks that a better deal would have been for ASDA to take over Morrisons - roughly comparable market positions, whereas ASDA and Sainsbury now bracket Tesco in brand proposition. Maybe that is the idea - leave Tesco no where to go either upmarket or downmarket. But what do Morrisons do? Stick or Twist?

According to industry stats here the combined ASDA/Sainsbury will have a larger market share than Tesco (30% compared to 28%) but after required divestments that may mean they are of very comparable size.

The question is - What next for Morrisons? Currently in 4th place with 10% they will automatically go up to 3rd, but be a third of the size of the two big supermarkets. This is stick or bust time I suggest. They could pick up retail units that ASDA/Sainsbury have to relinquish to please the authorities. But do they then go all out to get to, say, 15% share? OR do they stay where they are and hope to fend off Aldi on 7%?

I live in the home of Morrisons, Bradford, and would hope they go for growth, but part of me thinks that a better deal would have been for ASDA to take over Morrisons - roughly comparable market positions, whereas ASDA and Sainsbury now bracket Tesco in brand proposition. Maybe that is the idea - leave Tesco no where to go either upmarket or downmarket. But what do Morrisons do? Stick or Twist?

Monday, 23 April 2018

Procurex North - Manchester 24th April 2018

Tomorrow is Procurex North in Manchester at Manchester Central (which is part of the G-Mex complex). Free to people working in the public sector. Details here.

In the afternoon I am talking in the Winning Tenders Zone - so you can adapt your plans accordingly (listen or avoid).

There are a lot of good speakers during the day - especially in the Keynote Arena.

Hope to see you there.

Thursday, 22 March 2018

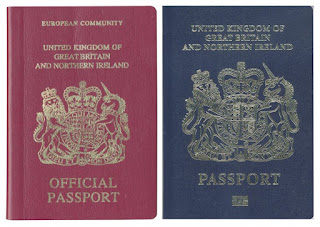

EU Procurement and Blue Passports

For once Public Procurement is big news. The big news is that a French/Dutch company with facilities in the UK has won the contract to print the new Blue British passports over a British company with some assets in Malta.

My TLDR verdict: Delarue should have written a better bid. (particularly if they are actually £120m more expensive has been indicated)

Friday, 16 March 2018

Procurex South - now onto Procurex North in Manchester 24th April 2018

Had a really good time at Procurex South. Thanks to Twitter posters for the photos. Lots of questions from delegates, which I hope I managed to answer. Good buzz around the place. Got to get away from the stand to hear very interesting bit from Professor Sue Arrowsmith on Public Procurement implications of Brexit. Her paper for the European Parliament last year is still the state of the art. Current situation is wait and see but don't expect major changes in the near future.

And so onto Procurex North in Manchester on 24th April 2018 - full details here. I am again running the Winning Tenders training zone. Hopefully with new insights, or at least new jokes.

Hope to see you there.

And so onto Procurex North in Manchester on 24th April 2018 - full details here. I am again running the Winning Tenders training zone. Hopefully with new insights, or at least new jokes.

Hope to see you there.

Friday, 9 March 2018

CIPS Introduction to Public Procurement Bristol 25th April 2018

I shall be running the CIPS Introduction to Public Procurement course in Bristol in April 2018. The next day is the Applying EU Public Procurement course, which follows on from the Introduction. This time round we are not following that up with the Future of Public Procurement day, but that will be next run in Manchester in June 2018. By which time the future of public procurement may have changed from where we are now - or may not. That one needs regular checking and updating.

This course covers the basics of Public Procurement and so is useful for people joining the Public Sector, joining procurement, wanting a refresher, taking over running a procurement department or trying to sell to the public sector. Or at least we often have delegates with those backgrounds. If you are just interested, you are still welcome.

This course covers the basics of Public Procurement and so is useful for people joining the Public Sector, joining procurement, wanting a refresher, taking over running a procurement department or trying to sell to the public sector. Or at least we often have delegates with those backgrounds. If you are just interested, you are still welcome.

Thursday, 8 March 2018

Procurex South 15th March 2018 - London Olympia

So, this is only a week away and I am looking forward to this. My sessions are in the Winning Tenders Training Zone in the afternoon, so I hope to get to see some of the keynote speakers in the morning, in particular Professor Sue Arrowsmith who will be talking about Brexit and Public Procurement, and Malcolm Harrison who is currently CEO of the Crown Commercial Service, but in the summer will take over the role of CEO of CIPS. And of course the brilliant Eddie Regan.

That's pretty top notch stuff. Well, maybe not me.

Friday, 16 February 2018

CIPS Public Procurement courses - Birmingham 20/21/22 February 2018

Next week I am running 3 days in Birmingham for the Chartered Institute of Procurement & Supply, covering UK Public Procurement. The first day is the Introduction and is fully booked (next one is 25th April in Bristol). Second one is Applying the Procurement regulations, and the third is the Future of Public Procurement .

3 good days, which can be taken as a block or one at a time - they are as standalone as I can make them.

3 good days, which can be taken as a block or one at a time - they are as standalone as I can make them.

Thursday, 8 February 2018

Zebra fuel

Listening to the BBC I came across Zebra Fuel, who are a start up in London who will come round to your house and fill up your car. They claim to be no more expensive than your local petrol station. Which in London is apparently turning out to be not so local.

In the North of England where I live land is not so important. But London has reached some quite staggering land and property values. I am constantly amazed that the commercial infrastructure continues to work as for almost any business in London there is more money to be made by closing the shop and selling the building than can be made in a generation of hard work. Ok, I have not done a detailed financial analysis, but I hope you can see where I am heading. The average 2018 property is selling for £600 000. Working on a 5% profit margin a shop has to bring in £12m to make that much money over a period of 24 years, say £500k per year, that is £10k/week, or £2k per day. How many shops turn over that much? Actually for a petrol station most, as that is only 40 fills - though really probably 80 would be needed as petrol only has profit margins of about 2.5%.

Anyway my point is that if you own a petrol station in central London you can have a quick windfall by selling it for development, or a long slow slog to make the same amount of money. (let's not worry about future property values, and net present value of money over 24 years...). Which would you do?

Petrol stations therefore are closing, and likely to continue to do so. Electrical vehicles will only make this trend worse in the medium term.The prevalence of small corner shops and Supermarket Local branches means that the petrol stations other role as the shop of last resort is covered.

Zebra therefore makes sense as a value proposition - they can invest in out of London depots and delivery vehicles (ironically possibly electric to avoid the congestion charge), which may turn out to have lower costs that being physically based in London. The customers don't waste their time finding a petrol station and then filling up. So in theory there could be lower operating costs, and customers (in future, once the principle is established) willing to pay a premium for convenience.

Sounds very plausible.

Apparently they have ambitions for Paris, but I suspect it will take a long time to come to Yorkshire.

It reminds me of a company in Manchester called Diesel Weasel who would go round and top up generators on construction sites on a daily basis. They are no longer around (it appears) but I think Zebra have a good chance. In business you never get more than that.

In the North of England where I live land is not so important. But London has reached some quite staggering land and property values. I am constantly amazed that the commercial infrastructure continues to work as for almost any business in London there is more money to be made by closing the shop and selling the building than can be made in a generation of hard work. Ok, I have not done a detailed financial analysis, but I hope you can see where I am heading. The average 2018 property is selling for £600 000. Working on a 5% profit margin a shop has to bring in £12m to make that much money over a period of 24 years, say £500k per year, that is £10k/week, or £2k per day. How many shops turn over that much? Actually for a petrol station most, as that is only 40 fills - though really probably 80 would be needed as petrol only has profit margins of about 2.5%.

Anyway my point is that if you own a petrol station in central London you can have a quick windfall by selling it for development, or a long slow slog to make the same amount of money. (let's not worry about future property values, and net present value of money over 24 years...). Which would you do?

Petrol stations therefore are closing, and likely to continue to do so. Electrical vehicles will only make this trend worse in the medium term.The prevalence of small corner shops and Supermarket Local branches means that the petrol stations other role as the shop of last resort is covered.

Zebra therefore makes sense as a value proposition - they can invest in out of London depots and delivery vehicles (ironically possibly electric to avoid the congestion charge), which may turn out to have lower costs that being physically based in London. The customers don't waste their time finding a petrol station and then filling up. So in theory there could be lower operating costs, and customers (in future, once the principle is established) willing to pay a premium for convenience.

Sounds very plausible.

Apparently they have ambitions for Paris, but I suspect it will take a long time to come to Yorkshire.

It reminds me of a company in Manchester called Diesel Weasel who would go round and top up generators on construction sites on a daily basis. They are no longer around (it appears) but I think Zebra have a good chance. In business you never get more than that.

Tuesday, 6 February 2018

IChemE: Engineering Procurement Online course

Well we are nearly at the end. The last webinar is tomorrow 7th February 2018 at 9am and 4pm.

This session is called Improving Engineering Procurement, and is based around a series of 5 tips to improve procurement in your organisation. It should pay for itself.

All 4 webinars will be available to buy online after the event.

Full details are here.

This session is called Improving Engineering Procurement, and is based around a series of 5 tips to improve procurement in your organisation. It should pay for itself.

All 4 webinars will be available to buy online after the event.

Full details are here.

Labels:

2018,

Engineering,

hints,

IChemE,

procurement,

tips,

webinar

Monday, 29 January 2018

IChemE webinar series: Engineering Procurement January 2018 - part 3; Price, Cost and Value

So the next webinar in our series is tomorrow, Tuesday 30th January 2018 at 9am and 4pm.

This time I am going to be talking about Price, Cost and Value. As well as looking at the Total Cost Iceberg, we shall touch on Volkswagen Group cars, the world's most expensive painting to date (see above) and why bottled water costs so much at Schipol airport.

Hopefully something in there for you.

The previous 2 webinars are available for purchase, and the last one will be next Wednesday 7th February 2018 and will give some (hopefully) useful hints and tips for improving Engineering Procurement.

Details are here.

This time I am going to be talking about Price, Cost and Value. As well as looking at the Total Cost Iceberg, we shall touch on Volkswagen Group cars, the world's most expensive painting to date (see above) and why bottled water costs so much at Schipol airport.

Hopefully something in there for you.

The previous 2 webinars are available for purchase, and the last one will be next Wednesday 7th February 2018 and will give some (hopefully) useful hints and tips for improving Engineering Procurement.

Details are here.

Labels:

2018,

Engineering,

IChemE,

Price cost,

procurement,

purchasing,

value,

webinar

Friday, 19 January 2018

IChemE webinar series: Engineering Procurement January 2018 - part 2

We have run the first module of four and the next one is on Tuesday 23rd January 2018 at 9am and 4pm. These are 2 different sessions so that we can pick the best recording and make it available for purchase on line.

So if you missed the first one you can still catch up by buying the course, and then joining in. I am happy to take questions as we go along, or at the end - which of course you cannot do unless you are joining the live sessions.

The first session was Introduction to Engineering Procurement.

The next one is about Supplier Positioning - how we segment what we spend, and how we get the right relationships with our suppliers.

Full details of the courses (or the recordings) is here.

Labels:

Chemicals,

Engineering,

IChemE,

procurement,

purchasing,

seminar,

webinar

Tuesday, 16 January 2018

Carillion - a little extra input

Couple of talking points keep coming up about Carillion.

Firstly that contracts should not be awarded to the lowest bidder - they usually are not in the Public Sector, but are awarded on the basis of Most Economically Advantageous Tender, i.e. Value for Money. Obviously price is a factor.

Secondly, sub-contractors accuse companies like Carillion of not paying promptly (Carillion seem to have used factoring of invoices, so that should not be a problem). Public Contracts require contractors to pay sub-contractors within 30 days. If they do not then a) the sub-contractor can charge interest at 8% above base rate (i.e. 8.5% at the moment) b) the public sector client can arrange to pay sub-contractors directly and c) late payment may be held against them as a reason for not allowing them to bid for future contracts (in extremis).

I'm not saying these are not problems - they are - but there are existing provisions that could deal with them if applied and enforced.

Firstly that contracts should not be awarded to the lowest bidder - they usually are not in the Public Sector, but are awarded on the basis of Most Economically Advantageous Tender, i.e. Value for Money. Obviously price is a factor.

Secondly, sub-contractors accuse companies like Carillion of not paying promptly (Carillion seem to have used factoring of invoices, so that should not be a problem). Public Contracts require contractors to pay sub-contractors within 30 days. If they do not then a) the sub-contractor can charge interest at 8% above base rate (i.e. 8.5% at the moment) b) the public sector client can arrange to pay sub-contractors directly and c) late payment may be held against them as a reason for not allowing them to bid for future contracts (in extremis).

I'm not saying these are not problems - they are - but there are existing provisions that could deal with them if applied and enforced.

Monday, 15 January 2018

Carillion - public sector contracts

I am sure that there are going to be a lot of "hot takes" on Carillion going into administration. It is too early for me to go into it in detail, but a couple of key points to think about.

1. Procurement has to look at Risk as well as price and cost - a consolidation of suppliers may lead to efficiencies but can also increase risk

2. Bigger is not necessarily safer than smaller. Think also of Connaught and the hard work Serco have had to do to turn themselves round from a big operating loss.

3. Apart from banks no UK business is too big to fail.

4. Contract management is key for the public sector. It ensures contractors cannot make up for underbidding by changes and variations

5. Buyers need to be very careful about possible underbidding (by SMEs and charities as well as big contractors) - companies need to make enough profit to ensure they survive when things go wrong. And at some point they will.

6. Split supply may be safer, but less efficient

7. Privately owned companies are not perfect. I know that is obvious, but it is not what we sometimes hear when we talk about private companies delivering public services.

8. Public sector contracts normally prevent suppliers from assigning contracts to third parties without the buyer's permission. We hear the government as been ensuring that Carillion contracts can be easily passed on to a new contractor of our choice. That is good news.

9. I would not expect many of Carillion's contracts to be re-tendered in the near future. Short term continuity will take precedence over the need for competition.

10. This will look bad on the UK, as overseas contracts will also be thrown into disarray including work on the Qatar world cup which like all such projects is on a tight timetable.

11.Finally, spare a thought for the sub-contractors and suppliers. They are likely not to be paid anything for a long time, and then be offered pennies on the pound. It is likely some will go bust. It is not their fault, nor (most) of Carillion's staff and I hope they manage to get through.

This is another major shock to Britain's construction industry (after the collusion prosecutions, and Connaught). I hope it can bounce back quickly

1. Procurement has to look at Risk as well as price and cost - a consolidation of suppliers may lead to efficiencies but can also increase risk

2. Bigger is not necessarily safer than smaller. Think also of Connaught and the hard work Serco have had to do to turn themselves round from a big operating loss.

3. Apart from banks no UK business is too big to fail.

4. Contract management is key for the public sector. It ensures contractors cannot make up for underbidding by changes and variations

5. Buyers need to be very careful about possible underbidding (by SMEs and charities as well as big contractors) - companies need to make enough profit to ensure they survive when things go wrong. And at some point they will.

6. Split supply may be safer, but less efficient

7. Privately owned companies are not perfect. I know that is obvious, but it is not what we sometimes hear when we talk about private companies delivering public services.

8. Public sector contracts normally prevent suppliers from assigning contracts to third parties without the buyer's permission. We hear the government as been ensuring that Carillion contracts can be easily passed on to a new contractor of our choice. That is good news.

9. I would not expect many of Carillion's contracts to be re-tendered in the near future. Short term continuity will take precedence over the need for competition.

10. This will look bad on the UK, as overseas contracts will also be thrown into disarray including work on the Qatar world cup which like all such projects is on a tight timetable.

11.Finally, spare a thought for the sub-contractors and suppliers. They are likely not to be paid anything for a long time, and then be offered pennies on the pound. It is likely some will go bust. It is not their fault, nor (most) of Carillion's staff and I hope they manage to get through.

This is another major shock to Britain's construction industry (after the collusion prosecutions, and Connaught). I hope it can bounce back quickly

Wednesday, 3 January 2018

IChemE webinar series: Engineering Procurement January 2018

I am delighted to be dipping my toes into the webinar waters with a series on Engineering Procurement for IChemE.

These 4 webinars will be first run in January/February 2018, and will then be available to purchase from IChemE.

Details are here.

We start on Tuesday 16th January 2018 9am and 4pm. The advantage of joining us then is that you can take part in the live Q&A sessions.

Hope you can join us.

PS (sorry about getting the day wrong - definitely Tuesday 16th - part 2 Tuesday 23rd January 2018)

These 4 webinars will be first run in January/February 2018, and will then be available to purchase from IChemE.

Details are here.

We start on Tuesday 16th January 2018 9am and 4pm. The advantage of joining us then is that you can take part in the live Q&A sessions.

Hope you can join us.

PS (sorry about getting the day wrong - definitely Tuesday 16th - part 2 Tuesday 23rd January 2018)

Subscribe to:

Comments (Atom)